ST. PAUL, MINN. (Nov. 3, 2016) – CHS Inc., the nation’s leading farmer-owned cooperative and a global energy, grains and foods company, today announced earnings for fiscal 2016 of $424.2 million.

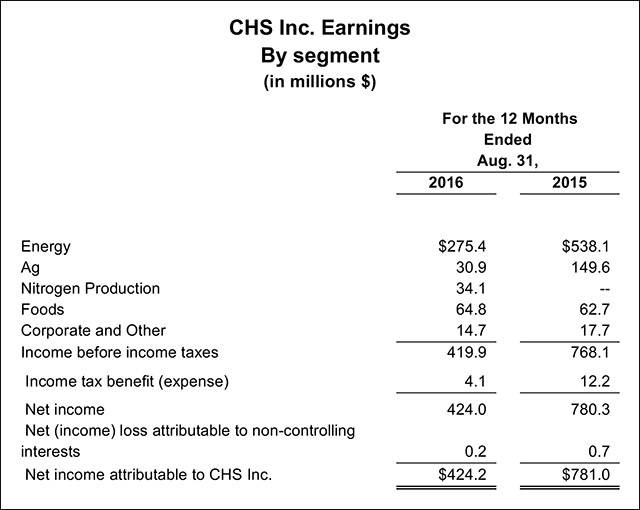

CHS net income for fiscal 2016 (Sept. 1, 2015 – Aug. 31, 2016) of $424.2 million was down 46 percent from $781.0 million for fiscal 2015, reflecting lower pre-tax earnings within the company’s Energy and Ag segments, as well as its Corporate and Other category. Lower pre-tax earnings within these two segments were partly offset by increased pretax earnings in its Foods segment, and seven months of earnings from its Nitrogen Production segment which was created by the February 2016 strategic investment CHS made in CF Industries Nitrogen, LLC (CF Nitrogen). These results reflect the continued economic down cycle in the company’s core energy and agriculture businesses, as well as the impact of one-time events.

“Like others in our core businesses of agriculture and energy, the ongoing global downturn continued to affect both our earnings and revenues in fiscal 2016,” said Carl Casale, CHS president and chief executive officer. “Meeting the long-term needs of our owners and customers remains our priority as we continue to take prudent actions to ensure the company remains financially sound and positioned for future opportunities.”

Revenues for the fiscal year were $30.3 billion, down 12 percent from $34.6 billion for fiscal 2015, primarily due to lower prices for the commodity energy, grains and fertilizer products that comprise much of the company’s business.

“As fiscal 2017 unfolds, CHS will sustain its focus on its financial and operational priorities. This includes always putting safety first and taking mindful steps to maintain balance sheet strength and profitability,” Casale added. “We’ll continue to manage expenses and staffing prudently, while making investments in necessary maintenance and essential operational upgrades and ensuring assets deliver appropriate levels of return.”

Year-over-year pre-tax earnings for the CHS Energy segment declined 49 percent to $275.4 million for the year ended Aug. 31, 2016, primarily due to significantly lower refining margins for the company’s two refineries. Earnings for the company’s transportation business also declined. Record performance by CHS propane business for fiscal 2016 was significantly ahead of fiscal 2015 which included reduced crop drying and winter heating demand. The CHS lubricants business also reported record earnings for a second consecutive year.

CHS reports results for its agricultural inputs, grain marketing, local retail and processing businesses under the Ag segment. The company recorded fiscal 2016 Ag earnings before taxes of $30.9 million, down 79 percent from fiscal 2015, a year in which results included a $116.5 million one-time impairment charge resulting from its decision to cease planned development of a nitrogen fertilizer plant at Spiritwood, N.D.

Within the Ag segment, earnings for the company’s Country Operations local retail businesses declined primarily due to lower grain margins. This was partially offset by higher grain volumes in fiscal 2016 compared with fiscal 2015. Lower margins also contributed to a decline in earnings for the CHS wholesale crop nutrients business. CHS grain marketing earnings also decreased in fiscal 2016, primarily due to lower margins which were partially offset by higher volumes. CHS Processing and Food Ingredients saw lower year-over-year earnings for fiscal 2016, primarily due to costs associated with the sale and impairment of assets, along with a specific customer receivable and, to a lesser extent, lower soybean crushing margins. The company’s renewable fuels marketing and production operations also declined from fiscal 2016 as a result of lower ethanol market prices, also partially offset by increased volumes.

CHS recorded fiscal 2016 income before taxes of $34.1 million, net of allocated expenses, from its February 2016 investment in CF Nitrogen reported in the company’s Nitrogen Production segment. In addition, CHS recorded fiscal 2016 pre-tax earnings of $64.8 million, net of allocated expenses, for its ownership in Ventura Foods, LLC, under its Foods segment; these results had previously been reported under the Corporate and Other heading. Within the Corporate and Other category, CHS reported slightly higher earnings for fiscal 2016 for its business services operations, including the company’s insurance, risk management and financing businesses, while year-over-year income from its ownership in the Ardent Mills, LLC, wheat milling joint venture declined.

In fiscal 2016, based on fiscal 2015 earnings, CHS returned $515.7 million to its owners as cash patronage, equity redemptions, preferred stock and dividends on preferred stock to its owners. Based on fiscal 2016 results, the company expects to return about $337 million to owners during fiscal 2017.

For further information, contact Lani Jordan, 651-355-4946

This article and other CHS Inc. publicly available articles contain, and CHS officers and representatives may from time to time make, “forward–looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Report Act of 1995. Forward–looking statements can be identified by words such as “anticipate,” “intend,” “plan,” “goal,” “seek,” “believe,” “project,” “estimate,” “expect,” “strategy,” “future,” “likely,” “may,” “should,” “will” and similar references to future periods. Forward–looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on CHS current beliefs, expectations and assumptions regarding the future of its businesses, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward–looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of CHS control. CHS actual results and financial condition may differ materially from those indicated in the forward–looking statements. Therefore, you should not rely on any of these forward–looking statements. Important factors that could cause CHS actual results and financial condition to differ materially from those indicated in the forward–looking statements are discussed or identified in CHS public filings made with the U.S. Securities and Exchange Commission, including in the “Risk Factors” discussion in Item 1A of CHS Annual Report on Form 10–K for the fiscal year ended August 31, 2016. Any forward–looking statements made by CHS in this document are based only on information currently available to CHS and speak only as of the date on which the statement is made. CHS undertakes no obligation to publicly update any forward–looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise.