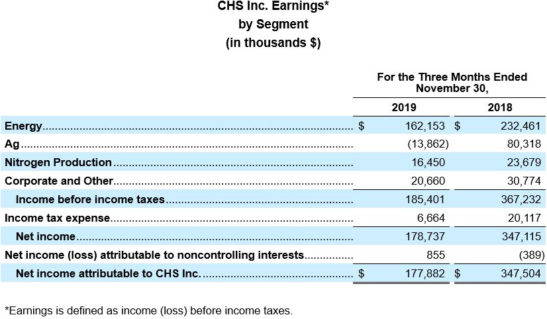

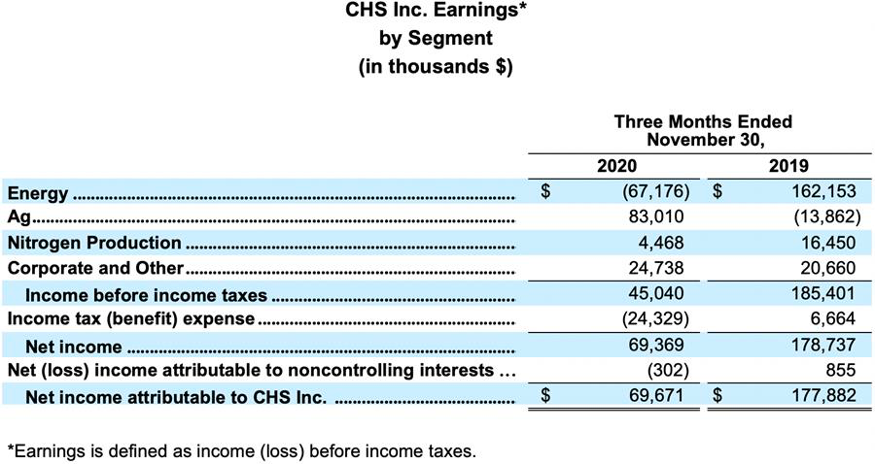

On Jan., 6, 2021, CHS Inc., reported net income of $69.7 million for the first quarter of fiscal year 2021 that ended Nov. 30, 2020. This compares to net income of $177.9 million in the first quarter of fiscal year 2020.

The results for the first quarter of fiscal year 2021 reflect:

- Revenues of $8.7 billion compared to revenues of $7.6 billion for the first quarter of fiscal year 2020.

- Impacts in the CHS Energy segment that included:

- Exceptionally low crack spreads and other unfavorable market conditions in our refined fuels business, driven primarily by the COVID-19 pandemic, resulted in volume and price declines that significantly reduced earnings in our Energy segment compared to the same period of the prior year.

- Decreased propane demand that resulted from warmer and drier fall weather during the first quarter of fiscal 2021 compared to the same period of the prior year.

- Impacts in the CHS Ag segment that included:

- Improved relations between the United States and foreign trading partners that drove increased volumes and margins for grain and oilseed.

- Favorable weather conditions during fall harvest compared to the prior year that drove increased volumes and margins across much of our Ag segment.

“Our employees’ commitment throughout the first quarter allowed us to consistently deliver products and services to our owners and customers around the world,” said Jay Debertin, president and CEO of CHS Inc. “A good growing season led to a good harvest season, and we saw commodity price rallies from spring and summer carry into fall. Those good weather conditions led to the highest volume fall fertilizer season we’ve seen since 2013 despite volatility in the nitrogen and phosphate markets.

“Improved trade opportunities with China and improved trade activity in Europe and Africa helped drive first quarter improvement in our global grain business. Our animal nutrition volumes also saw growth in the first quarter of fiscal year 2021,” Debertin said. “We saw year-over-year increases in premium diesel sales with rural America continuing to rely on us for their energy needs. However, our overall Energy segment experienced ongoing challenges on refined fuels margins as the pandemic continues to challenge the energy industry. Throughout the remainder of our fiscal year, we will remain focused on our key priorities including protecting the financial health of CHS, caring for those who depend on us and bringing efficiencies to how we run our businesses and deliver products.”

This document and other CHS Inc. publicly available documents contain, and CHS officers and representatives may from time to time make, “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Report Act of 1995. Forward-looking statements can be identified by words such as “anticipate,” “intend,” “plan,” “goal,” “seek,” “believe,” “project,” “estimate,” “expect,” “strategy,” “future,” “likely,” “may,” “should,” “will” and similar references to future periods. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on CHS current beliefs, expectations and assumptions regarding the future of its businesses, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of CHS control. CHS actual results and financial condition may differ materially from those indicated in the forward-looking statements. Therefore, you should not place undue reliance on any of these forward-looking statements. Important factors that could cause CHS actual results and financial condition to differ materially from those indicated in the forward-looking statements are discussed or identified in CHS filings made with the U.S. Securities and Exchange Commission, including in the “Risk Factors” discussion in Item 1A of CHS Annual Report on Form 10-K for the fiscal year ended August 31, 2020. Any forward-looking statements made by CHS in this document are based only on information currently available to CHS and speak only as of the date on which the statement is made. CHS undertakes no obligation to update any forward-looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise except as required by applicable law.